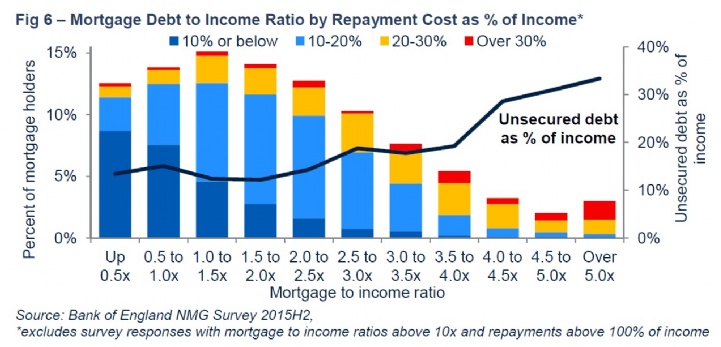

30+ mortgage as percent of income

So if your household gross income is 10000 a month your mortgage should be 1000 a month according to the. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Efsi Ex991 20 Pptx Htm

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Compare Loans Calculate Payments - All Online. Save Real Money Today.

Spend no more than 30 of your gross income on a monthly mortgage payment Traditionally the industry says to spend no more than 30 of your gross. Compare Your Best Mortgage Loans View Rates. Web What percent of their monthly gross income in the STATUS QUO budget is dedicated to the combination of their mortgage homeowners insurance and county property taxes.

Compare Now Save. Web As a general rule you want to spend no more than 30 percent of your monthly gross income on housing. Ad Get the Right Housing Loan for Your Needs.

Ad Check How Much Home Loan You Can Afford. Web The average 30-year fixed mortgage rate rose for the fourth consecutive week eclipsing 7 for the first time in 2023. Spend no more than 30 of your gross income on a monthly mortgage payment.

Compare Lenders And Find Out Which One Suits You Best. Compare Your Best Mortgage Loans View Rates. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

When considering a mortgage make sure your. Web It will seem extreme to the majority of people. 62 with 005 point.

Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Web Home-Buying Rule 1. Filters enable you to change the loan amount duration or loan type.

Comparisons Trusted by 55000000. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Web The rule is simple.

Ad 30 Year Mortgage Rates Compared. Looking For Conventional Home Loan. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Traditionally the industry says to spend no more than 30. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Lets say your total. Ad 5 Best Home Loan Lenders Compared Reviewed. 2022s Top Mortgage Lenders.

Your DTI is one way lenders measure your ability to manage. Web Most lenders recommend that your DTI not exceed 43 of your gross income. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender.

Select Apply In Minutes. Maximum household expenses wont exceed 28 percent of your gross monthly income. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

2 To calculate your maximum monthly debt based on this ratio multiply your. Compare Offers Side by Side with LendingTree. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. For example if your monthly income is 5000 you can.

Typically lenders cap the mortgage at. Ad Calculate Your Payment with 0 Down. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

If youre a renter that 30 percent includes utilities and if. Compare Offers Side by Side with LendingTree. Were not including any expenses in estimating the.

Web By default 30-yr fixed-rate loans are displayed in the table below. Ad Get the Right Housing Loan for Your Needs. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

Savills Guernsey Household Debt

What Percent Of Income Should Go To My Mortgage

Percentage Of Income For Mortgage Payments Quicken Loans

Huntington Bancshares Earnings Confirm Its Excellence Nasdaq Hban Seeking Alpha

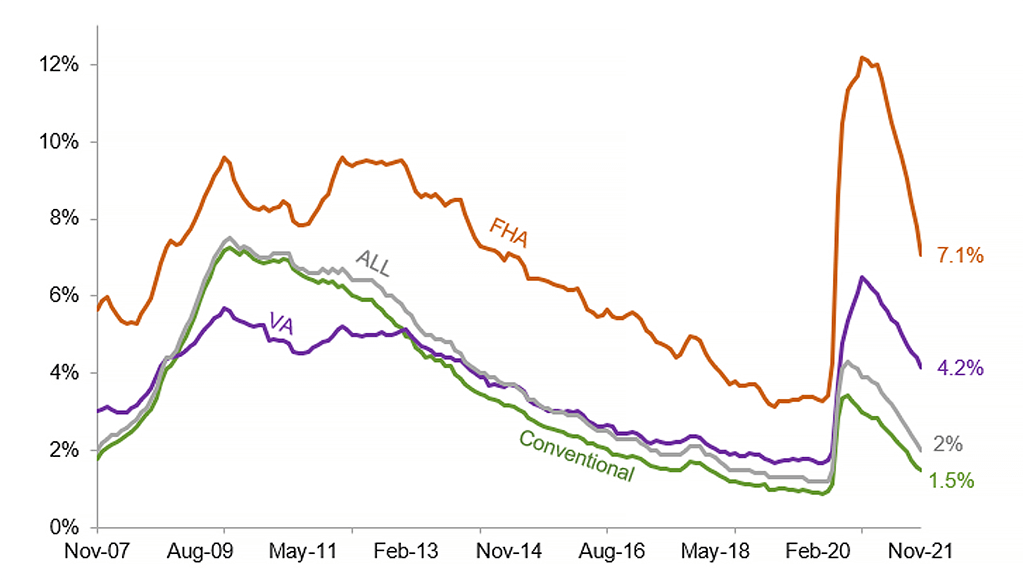

Serious Delinquency Rate For All Mortgage Loan Types Down From Last Year Corelogic

Home Values Oregon Office Of Economic Analysis

U S Mortgage Delinquency Rate 2000 2022 Statista

Capital One 30 Day Total Delinquency Rate 2021 Statista

Mortgage Lender Woes Wolf Street

Understanding Real Estate Data Investment Property Analytics Suburbsfinder

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go Toward A Mortgage

Affordability Of New Homes In U S Resumes Decline In 2022 Seeking Alpha

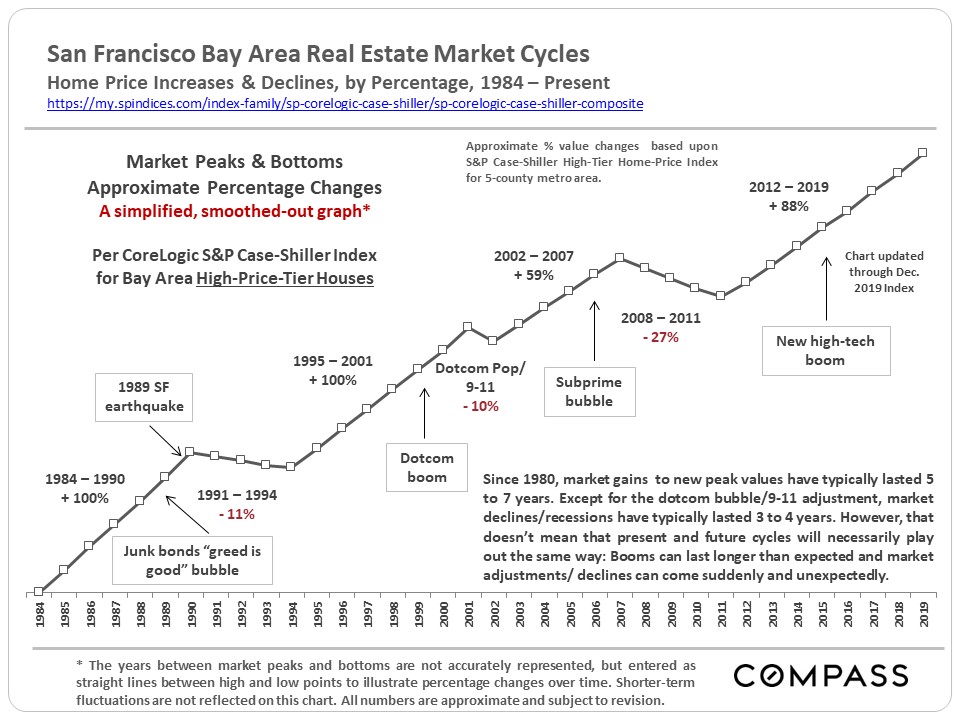

30 Years Of Bay Area Real Estate Cycles Compass Compass

Mortgage Applications Drop Despite Lower Mortgage Rates Industry Is Baffled Wolf Street

How Much Of My Income Should Go Towards A Mortgage Payment

Non Qualified Mortgage Loans Summertime Blues Continue Despite Improved July Delinquencies S P Global Ratings